Author: Taxbyte

-

Understanding Solidarity Surcharge – Solidaritätszuschlag

The Solidarity Surcharge, a supplementary tax introduced in Germany in 1991 to fund the costs of German reunification, has evolved to fund a broader range of government initiatives and projects. It is applied to individuals and corporations based on their income and capital gains taxes. Recently, the Bundestag passed a law diminishing the surcharge, completely…

Categories: Taxes -

Church Tax (Kirchensteuer) in Germany

The “Kirchensteuer” or church tax is a distinctive feature of Germany’s financial system, symbolizing the bond between church and state. Applicable to members of recognized religious communities, it’s a levy that accounts for about 8-9% of their income tax, with funds being critical for sustaining religious activities and institutions. Although non-payment can lead to sanctions…

-

Lohnsteuer – (Income Tax Withheld at Source)

Lohnsteuer, the income tax in Germany, is a pivotal element of the nation’s fiscal architecture, contributing significantly to financing essential public services. Its progressive nature adheres to the principle of financial fairness, ensuring the burden of contributions is proportional to income. The calculation of Lohnsteuer is determined based on various factors, including income level, marital…

-

Joint tax return in Germany

In Germany, the traditional joint tax return isn’t present but married couples can opt for a combined tax assessment called “Zusammenveranlagung.” Eligibility largely depends on marital status, residency, agreement between spouses, and presence of dependents. This option offers benefits like a potentially favorable overall tax rate, maximized eligibility for tax deductions and credits, spousal income…

-

Mandatory & Voluntary tax returns in Germany

In Germany, tax return obligations fall under two categories: mandatory and voluntary. Mandatory tax returns or “Pflichtveranlagung” apply to select individuals such as those with higher income or those self-employed, necessitating legal compliance and attention to detail. Voluntary tax returns or “Freiwillige Steuererklärung” are optional, providing individuals a chance to reassess their financial status, unlock…

-

How to change tax class in Germany

Germany’s tax system employs six classes, each tailored to situations including marital status, parenthood, or income discrepancies. The change in tax class, considering life events like marriage, divorce, parenthood, or income variations, might help individuals optimize their tax burden. Tax class modifications, both online (through Elster Online Portal) and offline (visit to the local tax…

Categories: Taxes -

Tax ID & Steuernummer, Master German Taxes: 4 Key Facts!

Navigating Germany’s tax landscape requires understanding two critical identifiers: the Tax Identification Number (TAX ID) and Steuernummer (tax number).

Categories: Taxes -

3 Income Tax Secrets in Germany to Boost Your Refund!

Tax system, with its cornerstone Einkommensteuer or income tax, promotes economic fairness and supports public services. It’s based on a progressive tax rate structure where higher-income individuals contribute more to taxes. The system allows for a multitude of deductions, allowances, and credits, including Basic Allowance, Special Expenses Deductions, Extraordinary Burdens Deductions, Child Allowance, and Tax…

Categories: Taxes -

10 Must-Know Taxes in Germany to Maximize Savings now!

Taxes in Germany include income tax, (VAT), corporate income tax, capital gains tax, inheritance & gift tax, real estate transfer tax, solidarity surcharge, church tax, trade tax, and property tax.

Categories: Taxes -

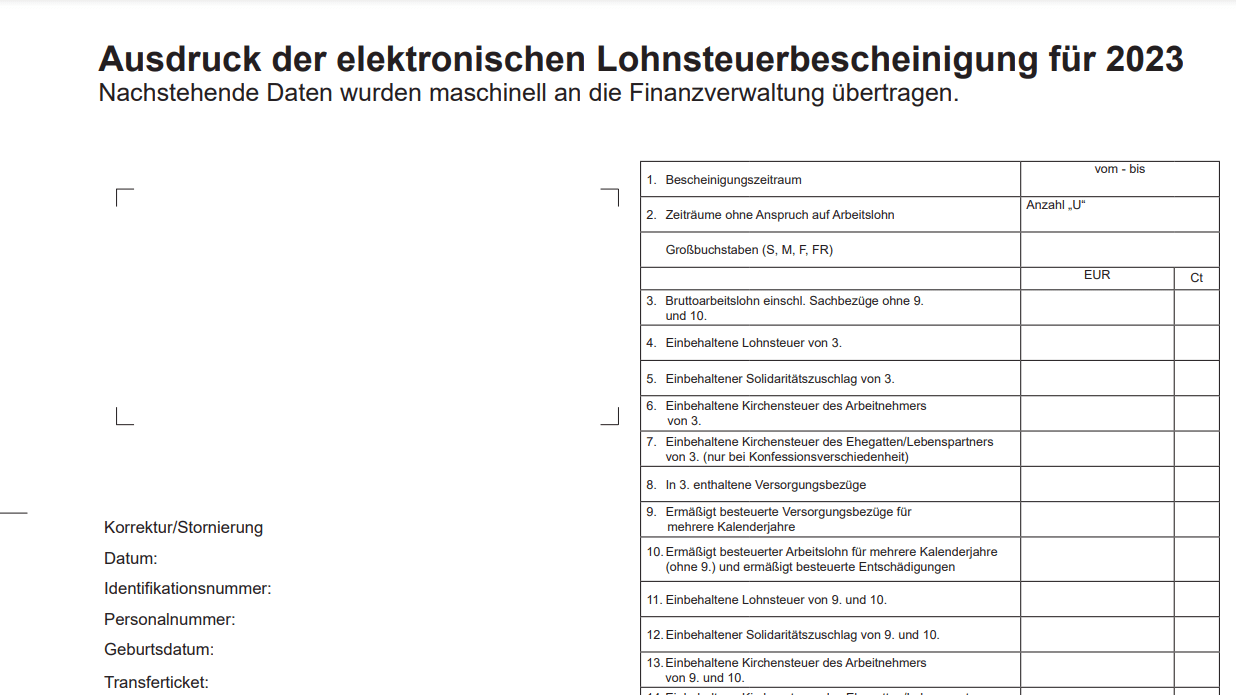

Claim More tax refund with Your Income Tax Certificate (Lohnsteuerbescheinigung)

Lohnsteuerbescheinigung, or income tax certificate, provided by employers, is crucial for understanding and managing one’s tax liabilities correctly.