Category: Students

-

Joint tax return in Germany

In Germany, the traditional joint tax return isn’t present but married couples can opt for a combined tax assessment called “Zusammenveranlagung.” Eligibility largely depends on marital status, residency, agreement between spouses, and presence of dependents. This option offers benefits like a potentially favorable overall tax rate, maximized eligibility for tax deductions and credits, spousal income…

-

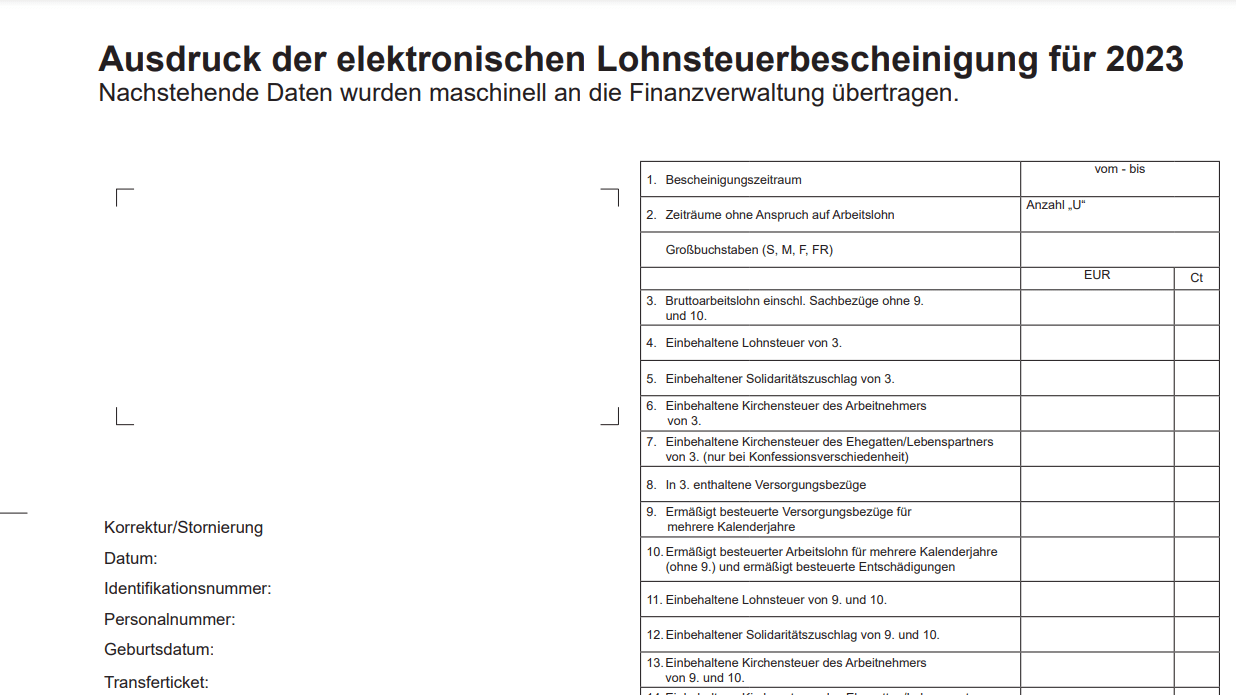

Claim More tax refund with Your Income Tax Certificate (Lohnsteuerbescheinigung)

Lohnsteuerbescheinigung, or income tax certificate, provided by employers, is crucial for understanding and managing one’s tax liabilities correctly.