All Tax Guides

Browse our comprehensive tax resources for students, employees, and freelancers in Germany. No confusion — just clarity.

All Categories

Lohnsteuer – (Income Tax Withheld at Source)

Lohnsteuer, the income tax in Germany, is a pivotal element of the nation’s fiscal architecture, contributing significantly to financing essential public services. Its progressive nature…

Joint tax return in Germany

In Germany, the traditional joint tax return isn’t present but married couples can opt for a combined tax assessment called “Zusammenveranlagung.” Eligibility largely depends on…

Mandatory & Voluntary tax returns in Germany

In Germany, tax return obligations fall under two categories: mandatory and voluntary. Mandatory tax returns or “Pflichtveranlagung” apply to select individuals such as those with…

How to change tax class in Germany

Germany’s tax system employs six classes, each tailored to situations including marital status, parenthood, or income discrepancies. The change in tax class, considering life events…

Tax ID & Steuernummer, Master German Taxes: 4 Key Facts!

Navigating Germany’s tax landscape requires understanding two critical identifiers: the Tax Identification Number (TAX ID) and Steuernummer (tax number).

3 Income Tax Secrets in Germany to Boost Your Refund!

Tax system, with its cornerstone Einkommensteuer or income tax, promotes economic fairness and supports public services. It’s based on a progressive tax rate structure where…

10 Must-Know Taxes in Germany to Maximize Savings now!

Taxes in Germany include income tax, (VAT), corporate income tax, capital gains tax, inheritance & gift tax, real estate transfer tax, solidarity surcharge, church tax,…

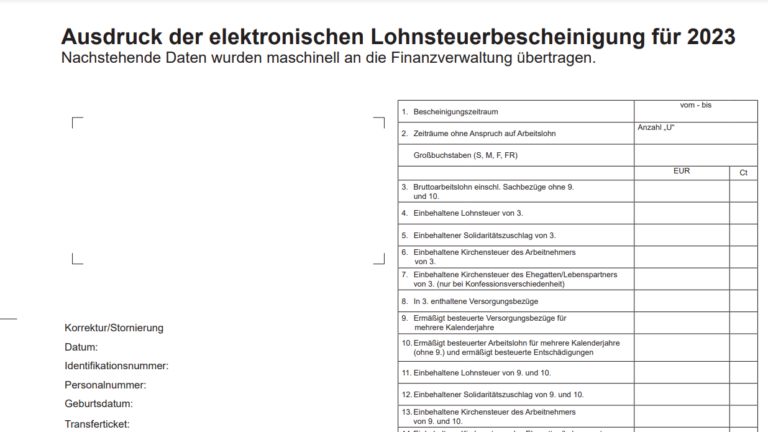

Claim More tax refund with Your Income Tax Certificate (Lohnsteuerbescheinigung)

Lohnsteuerbescheinigung, or income tax certificate, provided by employers, is crucial for understanding and managing one’s tax liabilities correctly.

German Tax Classes (Steuerklassen) 1-6 Explained: Boost Your Refund Today!

There are six different tax classes (steuerklassen) in Germany that can be assigned based on the professional situation of the individuals.